Crypto wallet

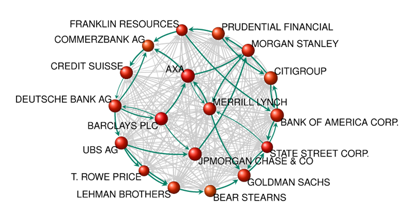

Private banks have made enormous progress at improving technologies for our convenience such as online banking, easy payments, etc. What does it matter if our money is not in our pockets, but in a bank?

Does it even matter that it is not even money, but a credit (called currency) lent to the bank? What we want is convenience and ease-of-use.

The security of the monetary system is hardly our responsibility.

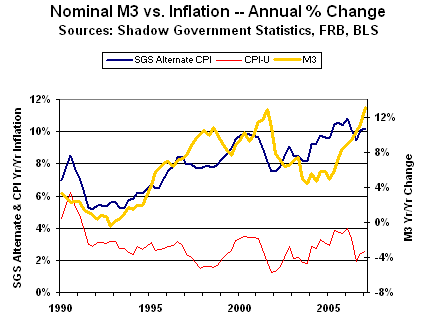

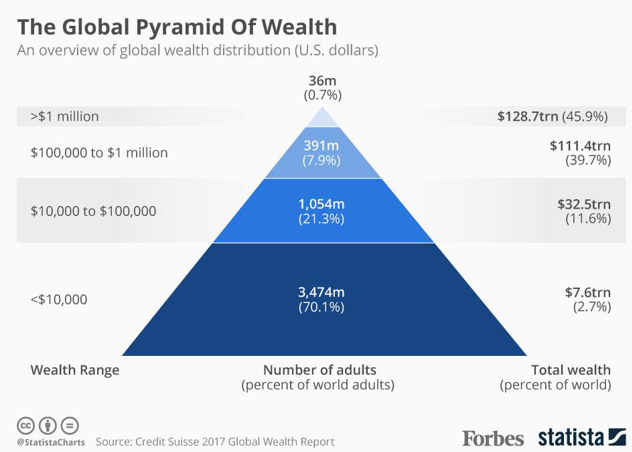

However the current monetary system is destroying our economies with debt, interest payments, inflation, and derivatives, all adding up to a crushing invisible tax on productive people.

In order to continue transacting and saving in a monetary disaster (happens every 40 years or so, and currently overdue), we need a ready-made alternative money.

We could say carry gold and silver around for savings and payments, since they might have been generally accepted through common consent and attractiveness. (Could just as easily have been durable food). But stacking gold/silver coins returns to inconveniences of portability, security, and acceptance.

The inconvenience of transporting the money to make payments soon led to entrepreneurs (goldsmiths) storing the money and issuing portable bills. In the 1944 Breton Woods agreement the US would issue paper and electronic dollars representing (backed by) the gold in their safes (bounty from the war).

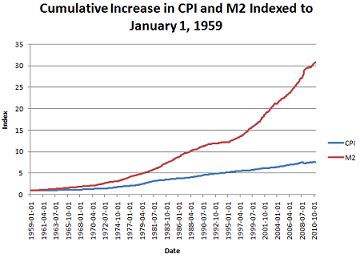

As expected, it was not long before printing of dollars exceeded the gold supply, and even coinage lost its precious metal content. Since 1971 in the US, and about 1973 in most other democracies, currency became completely fiat, backed by nothing but the coercion of tax authorities.

Among some recent efforts ingenious initiatives are those that store your precious metals in a vault and issue a electronic coins for your convenience to pay with (by transferring ownership of the gold/silver in the vault).

Crypto coins replace the vault with a blockchain, where owners hold the keys to their coins in their wallets (representing ownership on the blockchain).

Banks and bureaucracies have made using gold/silver and cryptos almost impossible by throttling acquisition. Besides to purchase these (crypto- or precious coins) one needs to have fiat to start with (converting a convenient currency to an inconvenient coin). Even in a doomsday scenario, it is the very fiat that will fail, and thus be worthless to purchase coins.

Furthermore blockchains and safes are still centralised and remote. Yes, vaults and crypto miners can be distributed, but your money is still not in your pocket (wallet). Vaults and miners cannot be downsized to mobile devices. Level two (off-blockchain) proposals still carry the entire network and all transactions at each node.

Even if electronic, it is still a derivative representing a coin in a vault or blockchain somewhere else.

To summarise, the following stumbling blocks are raised:

The amount of credit and the terms a vendor will accept depends on the credit score of the trading partner.

Thus participants are free of fiat and permission. (Crypto credit is of course still obtainable with fiat, crypto- or precious coin as well)

However it quickly raises the question of security. Unlike physical gold/silver coins that can be stolen, modern crypto wallets typically have two factor authentication and easy online backup, making theft or loss of a device irrelevant.

The different between this proposal and an electronic wallet carrying a key to a coin in a vault or blockchain, is that there is no vault or blockchain. The independent wallets are thus lightweight enough to run on mobile devices.

It is like having physical coins securely in your possession.

Partners are identified when a transaction is to take place, and mutual interrogation (for credit rating, for eg.) is private. Just as a stolen wallet cannot be accessed, so the credit score of a personal wallet cannot be altered by the owner.

In order to promote acceptance, in competition with banks, it will need to make payments easier than contemporaries. In some countries there is still a window of opportunity before banks get on board with the tools already in use in East Asia.

Flexible terms (with each transaction) can make it attractive for vendors to accept crypto credit at a premium, or as part payment

Does it even matter that it is not even money, but a credit (called currency) lent to the bank? What we want is convenience and ease-of-use.

The security of the monetary system is hardly our responsibility.

However the current monetary system is destroying our economies with debt, interest payments, inflation, and derivatives, all adding up to a crushing invisible tax on productive people.

In order to continue transacting and saving in a monetary disaster (happens every 40 years or so, and currently overdue), we need a ready-made alternative money.

We could say carry gold and silver around for savings and payments, since they might have been generally accepted through common consent and attractiveness. (Could just as easily have been durable food). But stacking gold/silver coins returns to inconveniences of portability, security, and acceptance.

The inconvenience of transporting the money to make payments soon led to entrepreneurs (goldsmiths) storing the money and issuing portable bills. In the 1944 Breton Woods agreement the US would issue paper and electronic dollars representing (backed by) the gold in their safes (bounty from the war).

As expected, it was not long before printing of dollars exceeded the gold supply, and even coinage lost its precious metal content. Since 1971 in the US, and about 1973 in most other democracies, currency became completely fiat, backed by nothing but the coercion of tax authorities.

Among some recent efforts ingenious initiatives are those that store your precious metals in a vault and issue a electronic coins for your convenience to pay with (by transferring ownership of the gold/silver in the vault).

Crypto coins replace the vault with a blockchain, where owners hold the keys to their coins in their wallets (representing ownership on the blockchain).

Banks and bureaucracies have made using gold/silver and cryptos almost impossible by throttling acquisition. Besides to purchase these (crypto- or precious coins) one needs to have fiat to start with (converting a convenient currency to an inconvenient coin). Even in a doomsday scenario, it is the very fiat that will fail, and thus be worthless to purchase coins.

Furthermore blockchains and safes are still centralised and remote. Yes, vaults and crypto miners can be distributed, but your money is still not in your pocket (wallet). Vaults and miners cannot be downsized to mobile devices. Level two (off-blockchain) proposals still carry the entire network and all transactions at each node.

Even if electronic, it is still a derivative representing a coin in a vault or blockchain somewhere else.

To summarise, the following stumbling blocks are raised:

- Difficulty onboarding (obtaining coins),

- Still not having your money in your pocket

- Inconvenience of payments

1. Onboarding

Currently acquisition of crypto- or precious coins are dependent on:- Fiat currency to purchase the coin (or mining rig), and

- Permission from banks and governments.

The amount of credit and the terms a vendor will accept depends on the credit score of the trading partner.

Thus participants are free of fiat and permission. (Crypto credit is of course still obtainable with fiat, crypto- or precious coin as well)

2. Wallet

Having your money in your pocket is like carry a coin purse under your control and ownership. That means you are not dependant on a government (currency), bank, a blockchain, or vault, to make a payment.However it quickly raises the question of security. Unlike physical gold/silver coins that can be stolen, modern crypto wallets typically have two factor authentication and easy online backup, making theft or loss of a device irrelevant.

The different between this proposal and an electronic wallet carrying a key to a coin in a vault or blockchain, is that there is no vault or blockchain. The independent wallets are thus lightweight enough to run on mobile devices.

It is like having physical coins securely in your possession.

3. Convenience

Payments would simply take place over any of the means of communication commonly available such as NFC, SMS, HTTP, etc., and making use of the myriad of services (APIs) already available for conversions, pricing, barcodes, etc.Solution

The solution proposed is an independent mobile wallet; independent of banks, vaults, blockchains, and level-two’s, (even of other wallets) that contains local transactions.Partners are identified when a transaction is to take place, and mutual interrogation (for credit rating, for eg.) is private. Just as a stolen wallet cannot be accessed, so the credit score of a personal wallet cannot be altered by the owner.

In order to promote acceptance, in competition with banks, it will need to make payments easier than contemporaries. In some countries there is still a window of opportunity before banks get on board with the tools already in use in East Asia.

Flexible terms (with each transaction) can make it attractive for vendors to accept crypto credit at a premium, or as part payment

![plan_negocios[1]](https://governingtaxfree.files.wordpress.com/2018/06/plan_negocios11.png)